FINTRUX

Getting an unsecured loan can be easy, fast, and affordable with FINTRUX ecosystem rating agencies, decentralized

technology and revolutionary credit enhancement.

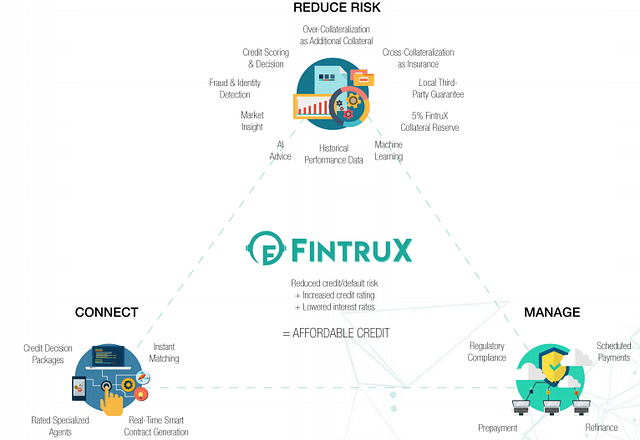

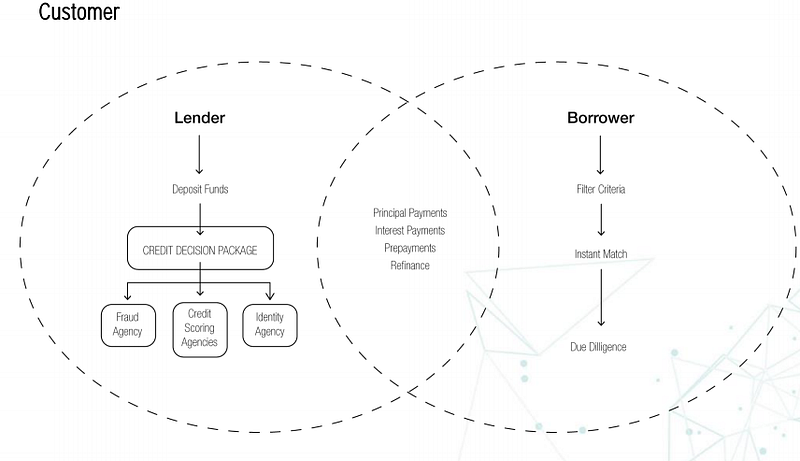

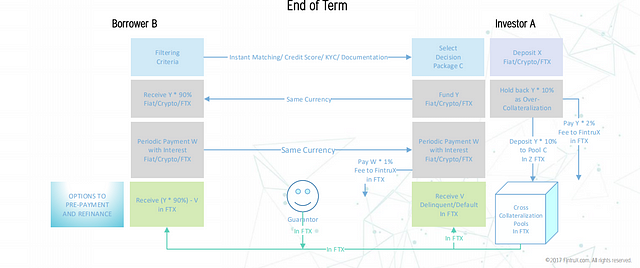

Cost reduction is one of the most important motivations in securitization. This is often done through increased credit. We can apply the same principle to reduce the interest rates required by unsecured loans, thus appealing to the borrower and lender. Our goal at FintruX Network is to disrupt the way unsecured loans are derived and managed. This paper provides an overview of the approach. Unsecured loans are loans that are not protected or secured by any asset. In this case the lender takes more risks and will do so likely to be subject to higher interest rates. The more risky the loan, the more expensive it is. We will change it. There is an option to get an unsecured loan for your business. Local banks, private lenders, and market lenders such as peers and platform direct lenders. However, there is room for improvement in the areas of transparency, risk reduction & interest rates, and the ease and speed of funding. The FintruX Network can provide the experience to handle all these things simultaneously. In the FintruX Network we facilitate market lending in the correct peer-to-peer network. Through credit enhancement, we are improving credit worthiness. The lender is assured that the borrower will honor the obligation through additional collateral, insurance, and a third party

guarantor. Increased credit reduces credit risk / default from debt, thus improving overall credit rating and lowering interest rates simultaneously.

Four levels of credit enhancement provide an unprecedented risk reduction to unsecured loans:

- Over-collateralization acts as an added security; and if it fails to cover all losses arising from the same borrower,

- Third party guarantors handle the overflow losses of the above loans; and if it still fails,

- Cross-collateralization pool provides additional insurance; and if it still fails,

- Five (5)% of all FTX Tokens have been provided to cover losses incurred by the lender.

STRATEGY

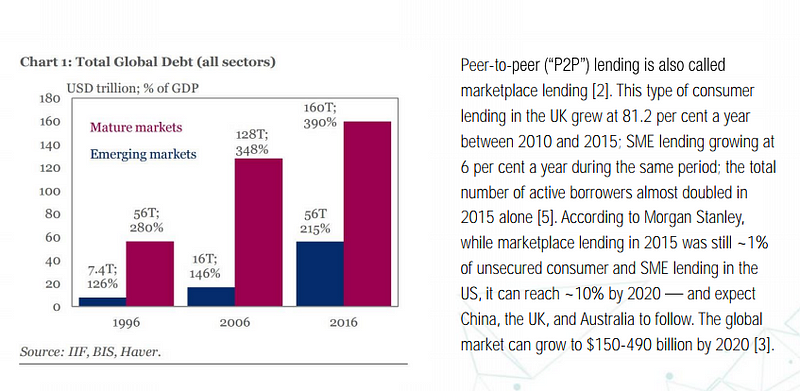

MARKET REVIEW

Traditional system is inadequate

Many Intermediaries

Most of the financing still comes from third parties such as brokers and other intermediaries. They sell their contract to a bank or originator who has a line of credit obtained from the bank. Credit line costs are then passed to New borrowers when their portfolio to a very large size of originators can securitize their contracts to get lower funding costs.

Fragmented and inconsistent

Most of the systems used are not fully automated, records can be fluid, censored, and subject to state patriotic action domicile. Today, various parties will keep a copy of their own data, and process it separately. This makes it difficult to sync and collaborate through a shared process. This adds tremendous complexity and cost to the audit.

Labor Intensive

Most financing contracts are difficult to understand and special

instructions such as refinancing, prepayment, semester final processing, etc. are mostly done manually on a spreadsheet.

Startups and Small Business are served

There are many small businesses, especially startups, ones

failed to get a loan from the bank:

- The required amount of loan is too small for the bank.

- Loans are usually carried by brokers who do not earn enough incentives on smaller loans to be followed up.

- Banks usually take a long time to reach a decision.

- The requirements of bank documentation are very high.

- Some small businesses do not meet PT's internal policy parameters banks even though they are worthy of credit with other standards.

Small Business Financing is Important for the Economy.

Cash flow is a problem for many businesses, and while fluctuations in cash flows may be small, they can have a profound effect on the business.

ability to run This is where unsecured loans come in. The ability of small businesses to access affordable credit is essential to stimulate and sustain a healthy, diverse and innovative economy. According to the Federal Deposit Insurance Corporation (FDIC), such as

March 31, 2014, there are $ 292 billion in commercial and industrial loans outstanding under $ 1 million.

Borrower Served Non-Current by Current Lending System.

Because underwriting underwriting fees and services are high, traditional banking systems are not suitable to meet the demands of small businesses

financing and the possibility of incurring additional fees and penalties. Online financing portals trying to bypass intermediaries have failed to resolve this issue.

The Lender has limited options to participate in small business financing.

Since individual investors generally do not have the size and access to invest in directly structured products, they can not invest in small amounts of business credit. While institutional investors have some access to this market, most have no tools to adjust their specific risk tolerance portfolio, and the banks that access these markets generally hold the loans they generate on their balance sheets. As a result of, we believe that the additional capital that can be invested in small business loans has largely been locked out of the market.

In short, FintruX Network offers an annoying environment that will benefit the global economy.

BUSINESS MODELS

FINTRUX NETWORK

KEY FEATURES

TECHNOLOGY

Blockchain

Our market utilizes blockchain technology

which offers all participants consistent, shared and

safe process The nature of decentralized blockchain enables completely trustless interaction between parties that remove third party fees and commissions. Our platform utilizes the Ethereal blocking and

Its smart contracts provide a comprehensive development environment and a great community.Personal, high

Performance Storage

To process certain transactions, private and

Confidential information is required to be stored and

exchanged. Our storage is a secure SQL database. I t

complement the blockchain network by providing

quick access to data such as borrower or other records

Confidential information Some level of security, external authentication and the use of a strong profile is involved.

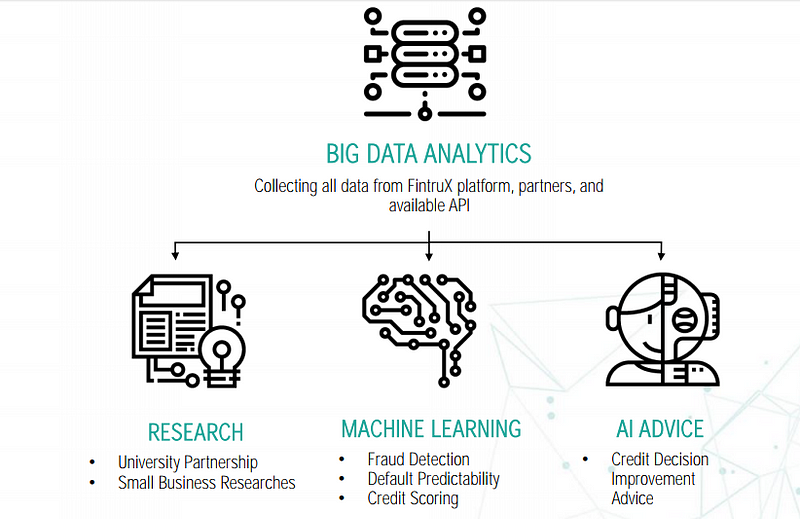

GREAT DATA

CASE TYPE USE 1

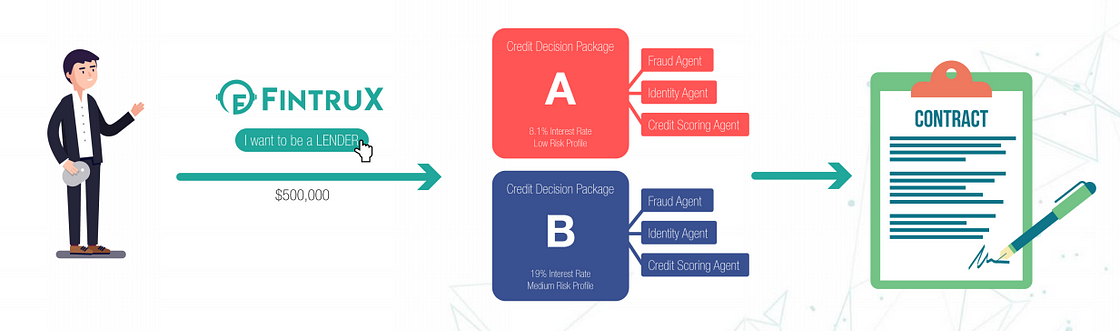

Paul, an airline pilot based in Toronto Canada, has an extra $ 500,000 savings he has not planned for a while. He decides to invest the money in a P2P loan, so he signs it until FintruX.com declares that he is the lender. He sent $ 500,000 to the FintruX Network on his behalf. After selecting two different credit decision packages with different risk profiles to divide the proportion, he proceeded to pay the equivalent of $ 20 in FTX for each packet to the service agent. The package also comes with recommended reputation scams, identity and credit scoring agents. He signed a power of attorney for the FintruX Network to conduct lending transactions on his behalf under the rules set out in the package. Paul is now ready to engage in automatic matching with the borrower. After successfully matching, he will pay a small commission on F TX to FintruX Network.

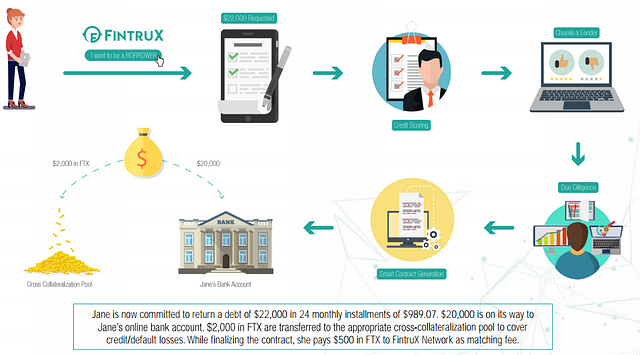

CASE OF USE TYPES 2

ROADMAP

Our Steps For Success

FintruX Network leads the way towards credit democratization, offering an innovative alternative to credit access.

- CREDIT ENHANCED FINANCING

Using the credit enhancement principles of securitization, FintruX delivers highly secure unsecured loans to benefit the small businesses borrowers, accredited

investors, and financial institutions of the world.

- ONE WORLD

By partnering with wallets, exchanges, and regulatory bodies, FintruX enables small business borrowers from countries with high interest rates to benefit from loans offered by lenders located in lower rate countries.

- ADDITIONAL LOAN TYPES

FintruX invites innovative asset classes created by other network partners to the ecosystem to become the go-to financing hub of the world. FintruX will provide a marketplace for lenders to trade their loans to one another.

The Team Behind It All.

for more information on fintrux please visit the link site located below:

Website : https://www.fintrux.com/#about-section

WhitePaper : https://www.fintrux.com/home/doc/whitepaper.pdf

Facebook : https://web.facebook.com/FintruX/

Telegram : https://t.me/FintruX

Ann Thread : https://bitcointalk.org/index.php?topic=2286042

Twitter : https://twitter.com/fintrux

AUTHOR

Gugun182: https://bitcointalk.org/index.php?action=profile;u=1268521

Myetherwaller: 0x7efFF5Dd57485721299cb4b79D8AE45993FDa6cE

Komentar

Posting Komentar